Most people will experience a huge decrease in monthly premiums when signing up for Medicare. Having large IRMAA charges can make a huge difference in whether you are spending a little or a lot each month on Medicare. Whether you sign up for a Medicare Supplement plan or an Advantage plan, high income earners are going to be stuck paying for your additional IRMAA charges.

What is IRMAA? Does IRMAA mean I pay more for Medicare?

IRMAA stands for Income-Related Monthly Adjustment Amount. IRMAA is a surcharge in monthly premiums for people with an income above a certain amount. Basically, if you are still employed and making a lot of money, you’ll be paying more for Medicare. IRMAA amounts show in the form of Medicare Part B and Part D additional premiums. The Social Security Administration determines whether you pay IRMAA based on the Modified Adjusted Gross Income you’ve reported from 2 years prior.

What is the Income Threshold for IRMAA in 2026?

You will only pay an additional IRMAA surcharge if you are making a certain amount of money. This amount changes every year. For 2026, if an individual is making more than $109,000, they have hit the first IRMAA threshold. For couples filing taxes jointly, the threshold is increased to $218,000 for 2026.

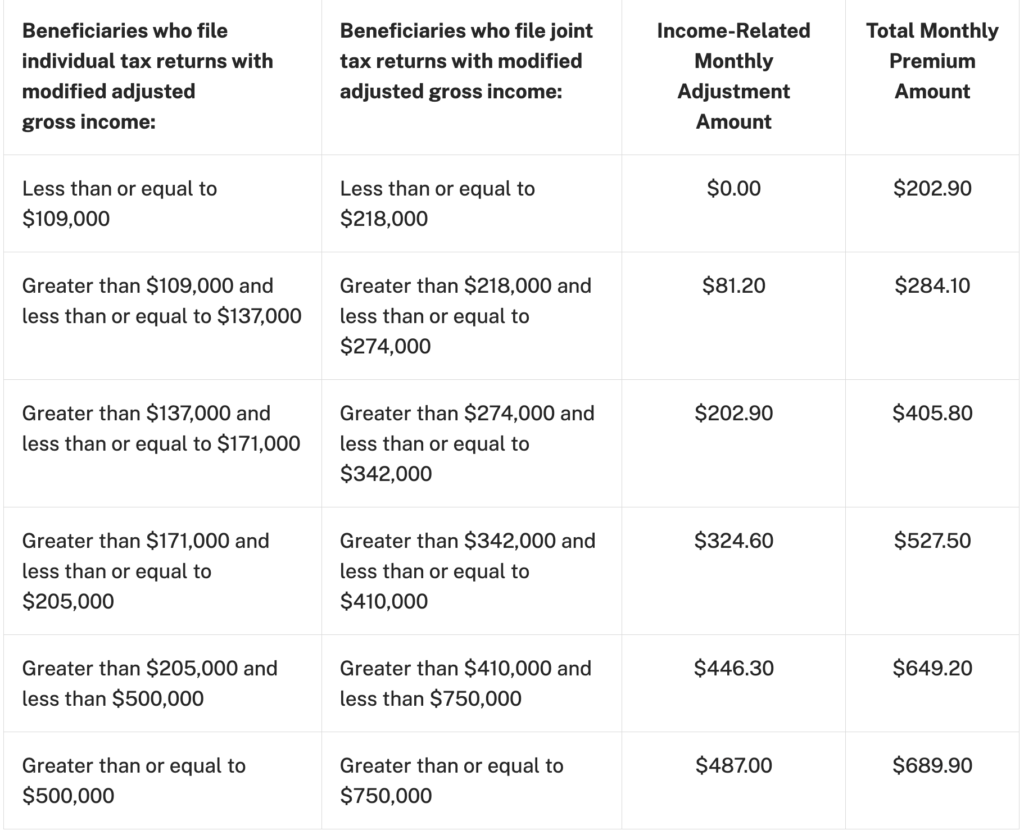

2026 Part B IRMAA Brackets:

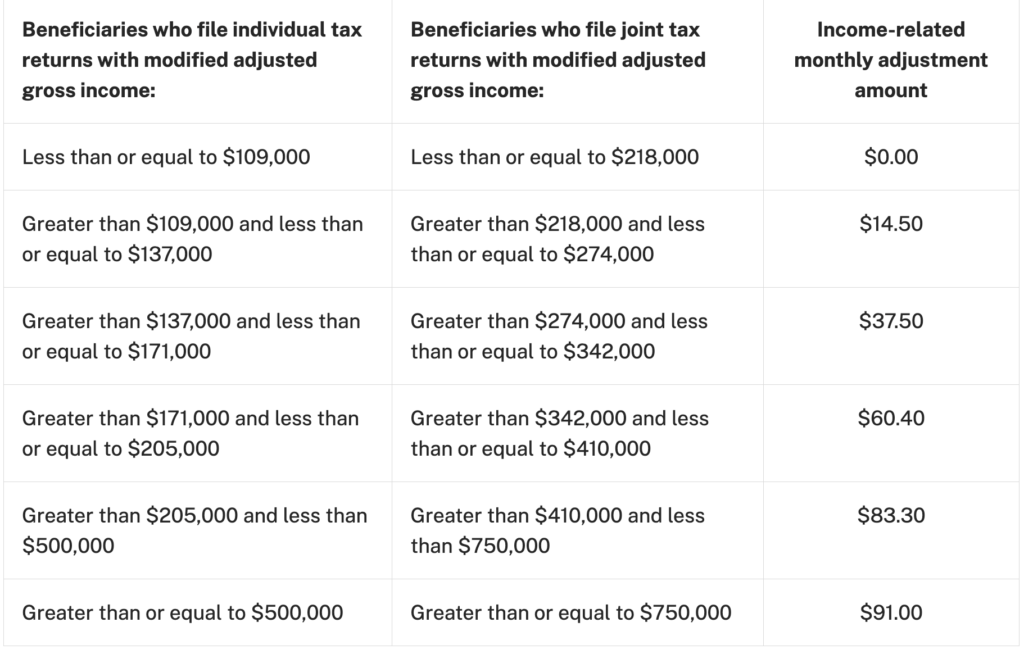

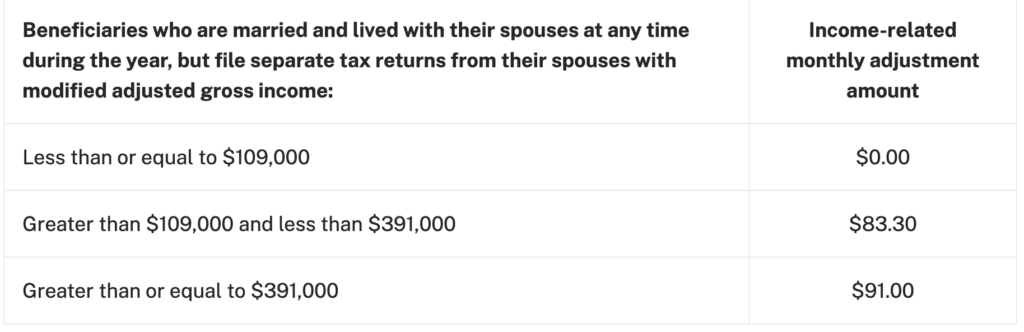

Both Part B and Part D have IRMAA charges. You’ll see the income threshold has not changed.

2026 Part D IRMAA Brackets:

How can I avoid IRMAA Charges?

If you are enrolling in Medicare, IRMAA charges are going to be unavoidable until your past 2 years of Modified Adjusted Gross Income has lowered.

Option 1 – Make less money or retire

- Pretty simple, if you make less money, you’ll avoid IRMAA. After retiring, you’ll see your Medicare monthly premium reduce to the base monthly premium. Your IRMAA doesn’t go away immediately when you retire. You need to continue reporting your income during tax season and your IRMAA will go down accordingly.

Option 2 – Sign up for your company’s health insurance

- If you are working for a large company with over 100 employees, this actually may be a great option. This company’s health insurance is a qualified plan that let’s you delay enrolling in Medicare. Furthermore, large companies have “composite based premiums” for health insurance. You pay the same price as someone who is very young. This is the best way to avoid paying IRMAA and still getting great insurance.

- If you work for a company with less than 100 employees, this is not a good option. These plans have age based premiums which will be more expensive than your IRMAA charges.

- If you work for a company with less than 20 employees, this idea is getting worse and worse. Those eligible for Medicare but enrolled in a company plan can receive late enrollment penalties if the company has less than 20 employees.

Can I avoid IRMAA by signing up for an Advantage plan?

No! You’ll still have to pay for IRMAA when signing up for an Advantage plan. Your Advantage plan will include Drug coverage, so you’ll have to pay the Part D IRMAA charges as well. There is no avoiding the IRMAA charges whether you sign up for an Advantage plan or a Supplement plan.

What is the Income Threshold for IRMAA in 2027?

2027 IRMAA rates have not been released just yet. These numbers are often posted very close to the new year. So we will have specific numbers for 2027 IRMAA closer to 2027. The IRMAA numbers for 2026 should be a good guidance for you to predict what the numbers will look like in 2027.

This information was gathered from the Center for Medicare Services – a government agency. Click here to read from their site.

Keaton Marks is the owner and CEO at HealthyMarks including the medicare team. Keaton was born and raised in Encinitas. He often rode his bike through town and to the local beaches like Moonlight. Keaton knows it is important to have a local resource, someone who understands the area, the hospitals and networks of doctors. Keaton is proud to be a local Medicare broker who is able to assist the people in his town when selecting medicare plans.

Keaton believes one thing above all else: “Medicare is confusing… but it doesn’t have to be! That is where HealthyMarks Medicare comes in” Please contact me with any questions.

I’m retired, so w2-income is zero. Although, If you pull large amount of money out of your 401K to build a house, will this reason exempt a person from paying IRAMA?

Hi Mark,

This is a great question and there is some grey area. IRMAA will be calculated based on your previous 2 years of “Modified Adjusted Gross Income.” So if that 401k money hits your “MAGI” on your tax documents, you’ll see that reflected in your IRMAA amount. However, there is a way to appeal to the Social Security Office to ask for an exception. We have a client that had your exact situation, was hit by a high IRMAA, but was able to convince the Social Security Office to lower their IRMAA because of their specific circumstance.

I’m retired. If I made a large 401k rollover to a Roth IRA. This will be included in my MAGI amount. Can I appeal to the Social Security Office to ask for an exception?

Yes, you can ask for an exception but it is unlikely that it will be successful. Any movement of funds that impact your MAGI is going to impact your IRMAA. Here is the link to submit the exception: https://www.ssa.gov/medicare/lower-irmaa

I sold two homes in 2024; one primary and a second home. I purchased a new home in 2024, thus had capital gains on the vacation home. I’m single and retired in 2024 at 63 yrs old. It looks like I will be able to file an appeal when I turn 65 and start receiving Medicare, next year.

Any idea how much money this will save me on Medicare costs for that one year? Looks like I’m in the 189000$ bracket which means 530$ monthly cost looking at the table for 2026.

Thank you for your comment. I do hope you get a chance to request an exception for your IRMAA, but there are never any guarantees. You can use this link here to submit the exception: https://www.ssa.gov/medicare/lower-irmaa

I am 71 years old and have been retired since 2019. I only signed up Plan A &B since I have company sponsored health insurance throughout for the rest of my life which will cover the drug insurance (Plan D). Do I still need to buy the drug insurance through Plan B and pay IRMAA premium?

Great question. If you have a qualified health insurance plan through your employer and it covers your prescriptions, you do not need to sign up for Part D nor do you need to worry about the IRMAA associated with it. Because of your employer plan that covers the costs of drugs, you will not have IRMAA in the future if you ever decide to sign up for Part D. If your drugs will continue to be covered by that employer plan, you’ll never need to sign up for Part D Medicare Drug Coverage.

Will an inheritance of $200,000 at age 76 affect me. My Social Security is less than $40,000

Because inheritance is not considered income, it should not show up on your taxes: Modified Adjusted Gross Income.

This should not have an impact on your IRMAA.

However, while there is no direct inheritance tax, you may still encounter other tax liabilities related to the inheritance:

– Income Tax on Inherited Assets: If you inherit assets that produce income (stocks that pay dividends, rental property, a retirement account), you will be taxed on that income.

– Retirement Accounts: Inherited IRAs or 401ks are generally subject to income tax upon withdrawal.

– Property Tax Reassessments (Prop 19): Inherited real estate may be reassessed at its current market value, which could increase annual property taxes.