UCSD Health Tightens Medicare Advantage Access Effective January 1st 2026

Starting in 2025, UC San Diego Health (UCSD) is making notable changes to how it accepts Medicare Advantage (Part C) Plans. If you’d like assistance in navigating this, don’t hesitate to reach out to HealthyMarks. We’re here to help you preserve the care you need, with minimal disruption.

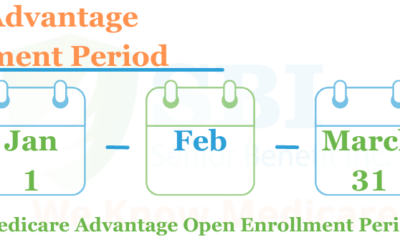

New UCSD Advantage Plans Effective Feb 1 2026: Medicare Advantage Open Enrollment Period (MA OEP)

Whether you’ve lost access to UCSD, or want better coverage overall, we’re here to help. The Medicare Advantage Open Enrollment Period runs from January 1 to March 31, 2026. Don’t miss this opportunity to switch plans and get the coverage you need. Contact HealthyMarks Medicare for a free consultation.

Navigating Medicare Enrollment: Tips to Avoid Late Penalties

Understanding the enrollment deadlines and penalties associated with Medicare Parts A, B, and D is essential for safeguarding your health coverage and financial well-being. We’ve discussed how delaying enrollment can result in increased premiums and gaps in coverage.

Jan 1 2026 AEP Update: UCSD Medical’s Changes to Medicare Advantage Plans – Humana, SCAN, UHC and Blue Shield

Members on Humana, SCAN, UnitedHealthcare®, and Blue Shield plans have all received letters from their carriers informing them they will no longer have access to UCSD in 2026. UCSD Medical will only accept a select number of Medicare Advantage plans while still accepting all Medicare Supplement plans (Medigap).

Cigna Medicare Plans Rebrand to HealthSpring for 2026

Beginning in 2026, Cigna’s Medicare Part D and Medicare Advantage plans will be rebranded under the HealthSpring name...

Scripps No Longer Accepts Medicare Advantage Plans

In 2024, Scripps will no longer accept Medicare Advantage plans but HealthyMarks can help you find a new plan this Open Enrollment.

Top 2 Reasons To Change Medicare Plans During Open Enrollment (AEP)

The top 2 reasons to change Medicare plans are because your health needs have changed or your prescription drugs have changed.

How to Avoid Paying 2026 IRMAA Surcharges for Medicare

Whether you sign up for a Medicare Supplement plan or an Advantage plan, high income earners are going to be stuck paying for your additional IRMAA charges.

What Can I Use My Health FSA For?

A Health Flexible Spending Account (FSA) lets you set aside money from your paycheck before taxes are taken out, which you can then use to cover eligible healthcare expenses. It’s a great way to save money while taking care of your health.

Avoid Overpaying for Prescriptions: Medicare Part D Tips

When signing up for Medicare, choosing the right Part D prescription drug plan depends entirely on what medications you take. Each drug is placed into a tier — generics are usually Tier 1 or Tier 2, while brand-name and specialty drugs fall into higher tiers.

Which is Better? A Co-Pay or a Co-Insurance?

A Co-Pay is a dollar amount that you will pay for your medical services. A Co-Insurance is a percentage amount. For example, I went to my primary care physician and had a Co-Pay of $50. I then took an x-ray and paid my Co-Insurance of 30%. Co-pays tend to be more predictable than coinsurances.

Using the Birthday Rule to Move to a New Medicare Supplement Plan

The Birthday Rule is a state-specific regulation that gives Medicare Supplement policyholders the chance to switch plans around their birthday each year—without underwriting.

“I highly recommend HealthyMarks for any Medicare related needs” – Amy Savedra in Poway

“Alexa was extremely helpful. She followed up immediately, provided me with all the Medicare alternatives, and helped put me at ease. A very positive experience all around. I highly recommend using them for any Medicare related needs.”

“Alexa At HealthyMarks Medicare Was Essential” – Jim Boyce in Carlsbad

“Alexa at HealthyMarks was essential in helping me transition my elderly mom into a Medicare supplement program after Scripps ended their alliance with Advantage plan coverage. Her knowledge of available Medicare plans and options helped me navigate the enrollment process efficiently.”

Medicare and International Travel: What You Need to Know

On a Supplement Insurance plan, emergency medical expenses during international travel are covered for the first 60 days. After meeting a $250 annual deductible, this plan will cover 80% of Medicare-approved services, leaving you responsible for the remaining 20%. It’s important to note that foreign travel emergency coverage under Supplement Insurance policies has a lifetime limit of $50,000.

What to Do if You’re on an Alignment PPO Advantage Plan and Need Access to Scripps in 2025

Starting in 2025, Medicare clients with an Alignment PPO Advantage plan will no longer be able to receive care at Scripps Coastal and Scripps Clinic. You can switch to a Medicare Supplement plan that Scripps accepts under a guaranteed issue provision.

New Medicare Prescription Payment Plan: Easier Payments for Your Medications Starting 2025

Starting January 1, 2025, Medicare is introducing a new benefit that will make it easier for Part D enrollees to manage their prescription drug costs. The Medicare Prescription Payment Plan (MPPP), aims to spread these costs more evenly throughout the year, making them more manageable for patients.

Medicare Costs as You Age: Comparing Supplement and Advantage Plan Costs

Every October, during the Medicare Annual Enrollment Period (AEP), you have the opportunity to review and adjust your current plans. This period is an excellent time to: a) Explore if there are better-priced Medigap plans available for your age. b) Consider if a more cost-effective Medicare Advantage plan might better meet your needs.

Demystifying Medical Bills: Why You Shouldn’t Pay the First Bill

When faced with an expensive bill that doesn’t make sense, reaching out to your broker can be a game-changer. As someone who’s been in the industry for years, I’ve helped countless clients decipher their medical bills and, more importantly, get their insurance to cover the costs.

Should I Switch to Medicare or Stay on My Employer’s Insurance?

Are you unsure whether or not you’d be better off on Medicare or your Employer Insurance? Reach out to HealthyMarks for one of our free services: Plan Evaluation Comparisons. If you are not sure whether your plan is better or worse than offered through Medicare, our team can help with an objective approach to plan evaluations.

Insurance carriers pay brokers like us to help you enroll in your Medicare plans.

So you can enroll with a professional free of charge!